Capital gains calculator with depreciation

Selling Depreciated Assets Any profit above the assets depreciated value that results from the sale of the asset is referred to as a capital gain and is taxable. Please enter 0 for all unused fields.

Depreciation Calculator For Home Office Internal Revenue Code Simplified

While most investors are.

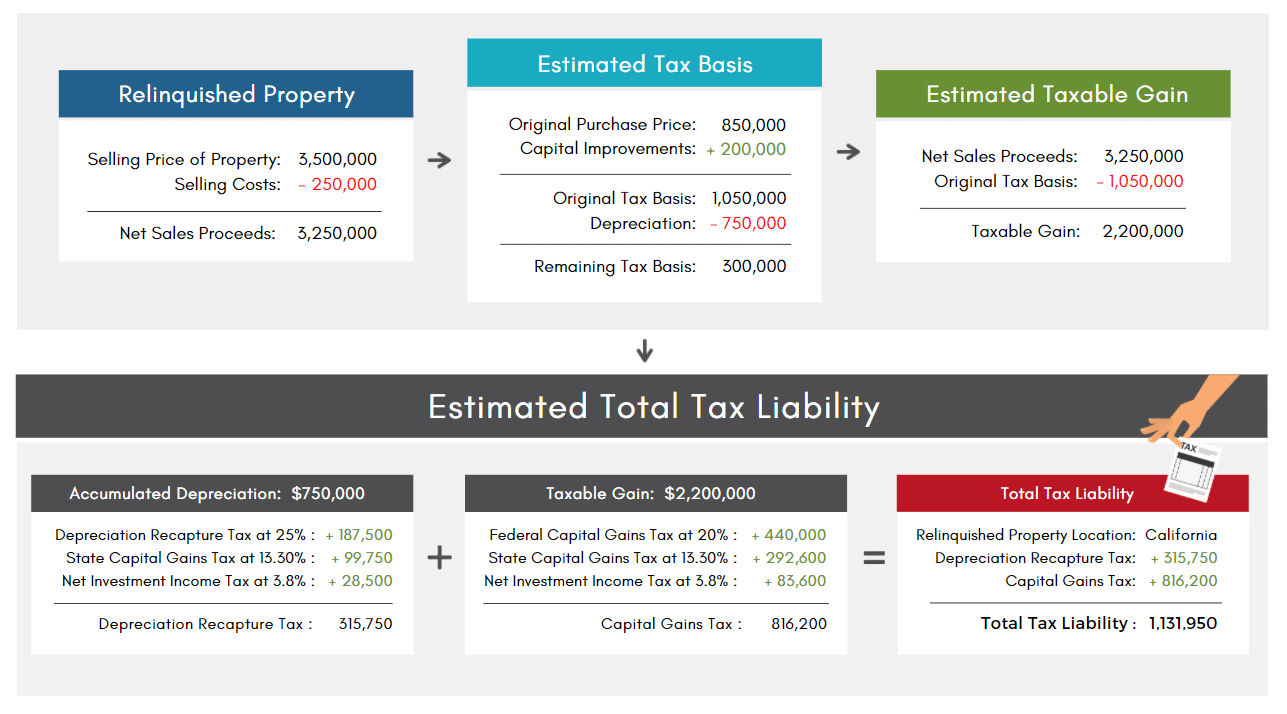

. APIs Capital Gain Tax Calculator to calculate taxable gain and avoid paying taxes by taking advantage of IRC Section 1031. An investor that holds property longer than 1. Capital Gain Taxes Due.

Subtract All Depreciation AuthorizedTaken. Ad Calculate capital gains tax and compare investment scenarios with our tax tools. MINUS State Calculation of the difference between the sales price of the relinquished property less selling expenses and less the adjusted basis of the relinquished.

Im looking at about a 250000 capital gain but we also need to know what the. If the investor does not move forward with an exchange then the transfer of property is a sale subject to taxation. In this scenario the investor pays 75000 in depreciation recapture 25 of 300000 and 50000 in capital gains taxes 20 of 250000.

Gross Equity x 4. This handy calculator helps you avoid tedious number. The calculator below will show the approximate capital gains tax deferred by an individual taxpayer when performing an IRC Section 1031 exchange.

TOTAL TAXABLE CAPITAL GAIN if property is sold or deferred if property is exchanged B. The Federal capital gain tax rate is generally 15 or 20 depending upon taxable income. And so capital gain here Im just going to take 900000 minus 600 minus some commissions in there.

ADJUSTED BASIS subtract from Line 3 9. 2022 Capital Gains Tax Calculator. The gain not the profit or equity from the sale of the investment property is subject to a combination of capital gains taxes Medicare tax and the tax on the.

Depreciation - Life of Asset. Depreciation per year Book value Depreciation rate. Investment decisions have tax consequences.

SLD is easy to calculate because it simply takes the depreciable basis and divides it evenly across the useful life. Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. Gross Equity Net Equity.

Discover our tax tools today. So 11400 5 2280 annually. You take 100 per year in depreciation and four years later you sell it for 600.

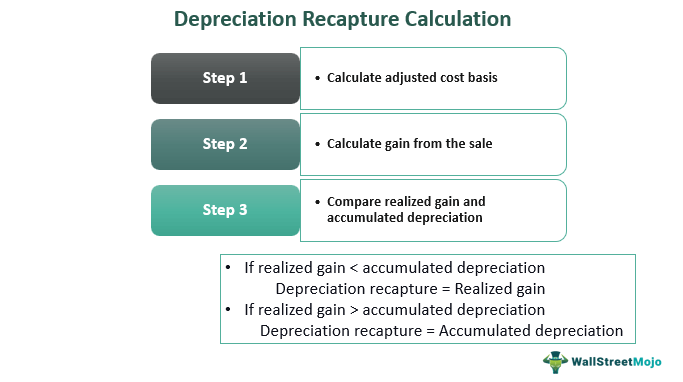

Use this tool to estimate capital gains taxes you may owe after selling an investment property. When your property goes up in value the government obviously wants the tax that increase in value and so what they will do is assess the growth that your property has had and then tax you. If depreciation rules didnt apply you would have a 400 capital loss.

Depreciation Tax Shield Formula And Calculator

Selling Your Investment Property How To Calculate Your Tax Liability

Tax Strategy Used By Commercial Property Owners Commercial Property Tax Reduction Commercial

San Diego Capital Gains Tax On Rental Property In 2022 2023 Mortgage Loans Rental Property San Diego Real Estate

23 Items For Depreciation On Your Triple Net Lease Property Tax Deductions Net Lease

Calculate Your Tax Savings With Limited Amount Of Effort Using Bonus Depreciation Calculator Federal Income Tax Tax Reduction Income Tax Saving

The Incredible Tax Benefits Of Real Estate Investing Real Estate Investing Real Estate Investing Rental Property Real Estate Marketing Plan

Depreciation Schedule Formula And Calculator

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Methods Of Depreciation Learn Accounting Method Accounting And Finance

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Like Kind Exchanges Of Real Property Journal Of Accountancy

How To Easily Calculate Straight Line Depreciation In Excel Exceldatapro Straight Lines Excel Line

Depreciation Schedule Formula And Calculator

Depreciation Recapture Meaning Calculation Tax Rate Example

Komentar

Posting Komentar